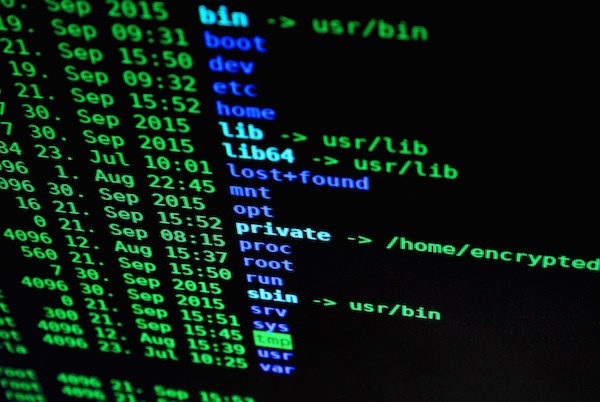

That’s probably what a lot of people thought when they first heard of the Equifax breach last week. After a bankruptcy rebuilding your credit score quickly is important. You don’t want anything getting in the way like a data leak. There have been a lot of mixed messages on what to do to protect yourself, now that most likely, your social security number, birth date, address and other personal information is floating around the universe. The breach affected 143 million people, which is basically every adult living in the United States.

The Equifax Data Breach: How To Ensure It Doesn’t Affect Your Credit Score

That’s probably what a lot of people thought when they first heard of the Equifax breach last week....

%20Filing%20Chapter%207%20Bankruptcy%20in%20Eden%20Prairie%2c%20MN.png)