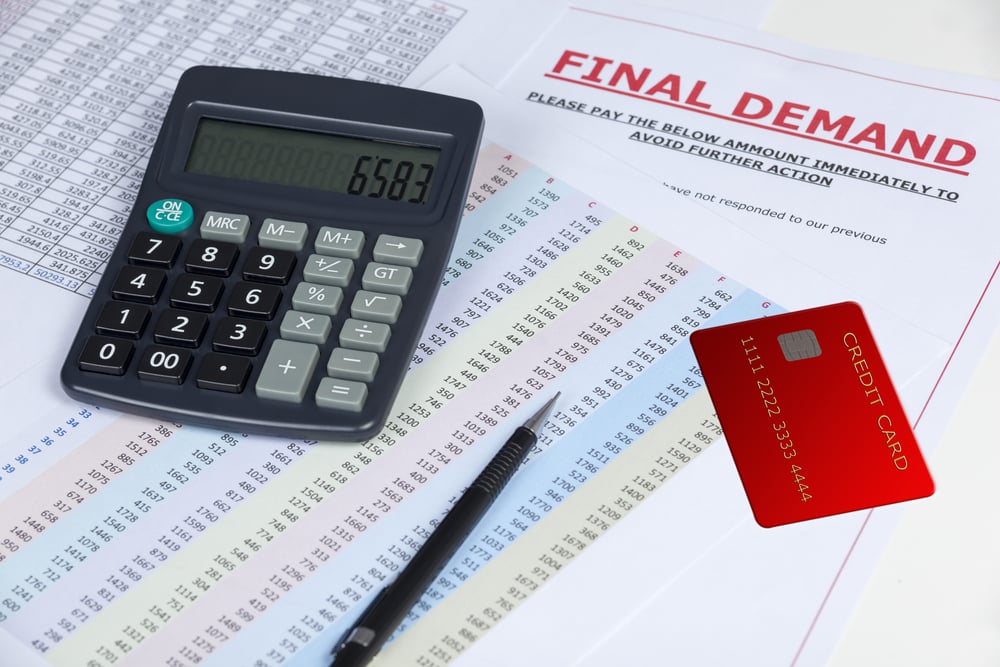

When we break it down, there are opportunities to rise above your current station in life, to do better than your parents, but if you already start out ahead of the curve, your chances of success are far higher.

DISCRIMINATION AGAINST THE POOR II

When we break it down, there are opportunities to rise above your current station in life, to do...

.jpg)