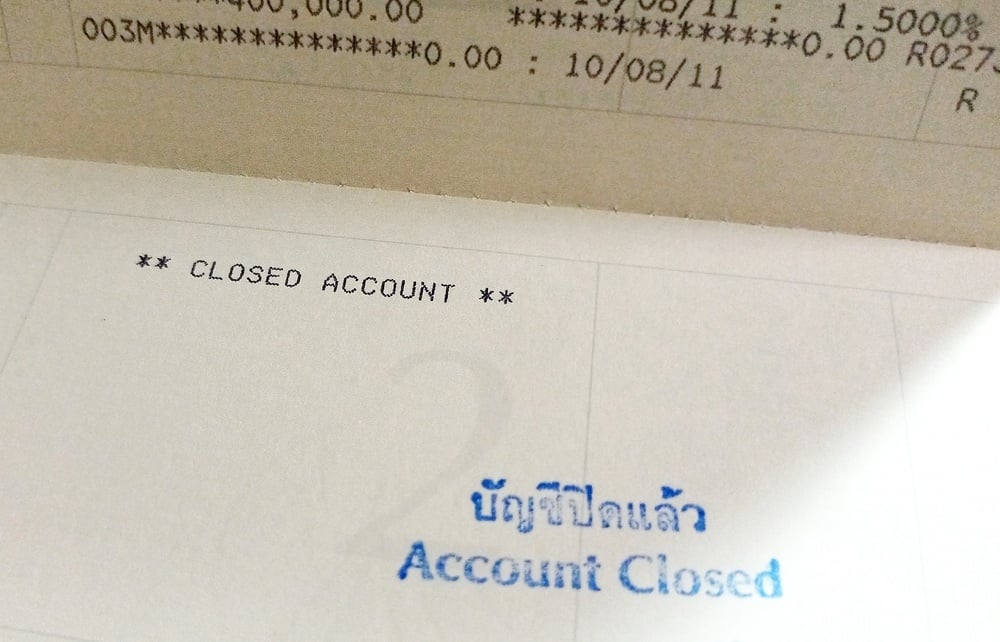

Filing bankruptcy may leave you feeling uncertain about your bank accounts. If you like your bank, you may want to keep it open, and if you do not like your bank or do not care one way or the other, you may be fine with it closing.

Bank Accounts Closing During Bankruptcy in Minneapolis, Minnesota

Filing bankruptcy may leave you feeling uncertain about your bank accounts. If you like your bank,...