I think one of the most anxiety producing events for a client is the meeting of creditors or 341 meeting. This is the meeting where the Chapter 7 trustee has debtor verify that the information on the schedules is true and correct and complete.

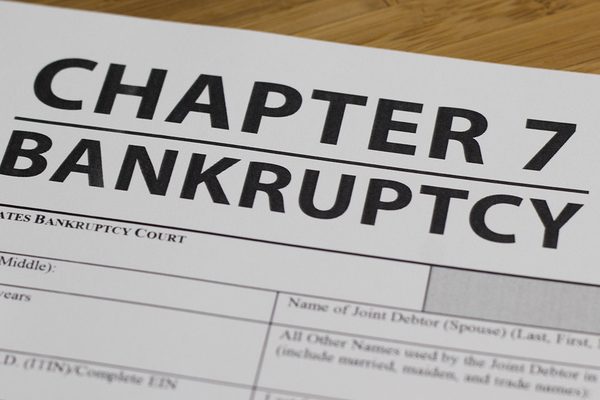

(Video) WHO NORMALLY ATTENDS A CHAPTER 7 MEETING OF CREDITORS?

I think one of the most anxiety producing events for a client is the meeting of creditors or 341...