When you do your taxes this year, your 2020 tax returns, you may encounter the Recovery Rebate Credit. The Recovery Rebate Credit is a protected asset in every bankruptcy case, chapter 7 or chapter 13. If you are owed this credit, this is not money that the trustee could ever get their hands on.

When you do your taxes this year, your 2020 tax returns, you may encounter the Recovery Rebate Credit. The Recovery Rebate Credit is a protected asset in every bankruptcy case, chapter 7 or chapter 13. If you are owed this credit, this is not money that the trustee could ever get their hands on.

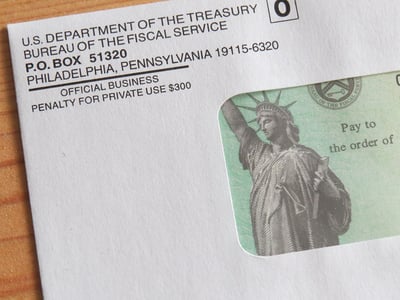

Economic Impact Payments

Most people that were eligible for the two rounds of stimulus checks (known as Economic Impact Payments) received the full of amount of the payments already. But some people didn’t receive both payments, or received less than the amount they were entitled to.

In this case, you are eligible for the Recovery Rebate Credit when you do your taxes. You must file a 2020 return to claim the credit, even if you are not required to file a tax return for 2020. You will need to know the amount of any stimulus checks you did receive in order to see if you are eligible for the credit.

If you find you are eligible for the credit, the credit will be issued to you as part of a tax refund with your 2020 IRS refund.

Are Tax Refunds Protected Assets in Minnesota?

When filing bankruptcy, tax refunds are not always a protected asset from the bankruptcy trustee. Some chapter 7 debtors will lose a portion of their refunds, though most are able to protect their full refund. In chapter 13 debtors are only able to keep the first $1200 in filing single or $2000 if filing jointly of their combined state and federal refunds.

The Recovery Rebate Credit, is a protected asset in every bankruptcy case, chapter 7 or chapter 13. If you are owed this credit, this is not money that the trustee could ever get their hands on. Like the stimulus funds, Congress made sure that these funds weren’t eligible to end up in the hands of the trustee, and that they stay in your pocket.

CALL NOW FOR A FREE STRATEGY SESSION FROM A MN BANKRUPTCY LAWYER AT KAIN & SCOTT

You should always consult an experienced bankruptcy attorney. If you have any questions or would like to schedule a consultation, please call 800-551-3292 or see us anytime at www.kainscott.com!